Approved members of the Financial Commission can enjoy new membership benefits with complimentary and discounted access to important services provided by our network of partners. Broker members can take advantage of trade execution certifications, actionable market research, virtual dealer tools and access to an exclusive invite-only community to help prevent fraudulent activity.

Synthesizing customer satisfaction with the most experienced and educated team of the financial markets and high-level technological opportunities, GreenFx is an industry leader that has fully adopted corporate governance principles.

GreenFx has been providing its investors with Tier 1 liquidity in foreign exchange, commodities and stock markets for years.

For more: https://greenfx.co

Advanced Markets is a pioneer bringing true Direct Market Access (DMA) liquidity, credit and technology solutions to the foreign exchange, CFD, energy and precious metals markets. The firm provides these solutions on a wholesale basis to banks and brokers globally. It also provides trade execution and prime brokerage solutions directly to hedge funds, commodity trading advisors, corporations and other institutional market participants.

FX Brokers can be assured that Advanced Markets’ institutionally-owned, and fully transparent DMA offering, goes beyond existing “no dealing desk”, STP, RFQ and ECN models by enabling anonymous and unfiltered direct access to real-time spot FX pricing in the interbank market, and instantaneous trade execution.

Through our partnership, approved broker members of the Financial Commission can expect to receive world-class wholesale liquidity, technology and credit solutions from a trusted and proven leader in the FX industry. Additionally, through the new Value-added service, members can receive monthly account credits of $2 per million on brokerage costs on behalf of the Financial Commission*.

The streamlined, flexible program setup enables FC members to tailor optimal liquidity and credit structures for their offerings, as well as set up new solutions rapidly to meet demand while enjoying special discounts to keep their transaction costs low.

*Financial Commission approved broker members transacting through Advanced Markets can receive a credit of $2 per million for their brokerage costs. The Financial Commission will provide such credits to approved broker members for the first year of use of Advanced Markets transacting services.

Advanced Markets is a pioneer bringing true Direct Market Access (DMA) liquidity, credit and technology solutions to the foreign exchange, CFD, energy and precious metals markets. The firm provides these solutions on a wholesale basis to banks and brokers globally. It also provides trade execution and prime brokerage solutions directly to hedge funds, commodity trading advisors, corporations and other institutional market participants.

FX Brokers can be assured that Advanced Markets’ institutionally-owned, and fully transparent DMA offering, goes beyond existing “no dealing desk”, STP, RFQ and ECN models by enabling anonymous and unfiltered direct access to real-time spot FX pricing in the interbank market, and instantaneous trade execution.

Through our partnership, approved broker members of the Financial Commission can expect to receive world-class wholesale liquidity, technology and credit solutions from a trusted and proven leader in the FX industry. Additionally, through the new Value-added service, members can receive monthly account credits of $2 per million on brokerage costs on behalf of the Financial Commission*.

The streamlined, flexible program setup enables FC members to tailor optimal liquidity and credit structures for their offerings, as well as set up new solutions rapidly to meet demand while enjoying special discounts to keep their transaction costs low.

*Financial Commission approved broker members transacting through Advanced Markets can receive a credit of $2 per million for their brokerage costs. The Financial Commission will provide such credits to approved broker members for the first year of use of Advanced Markets transacting services.

We are pleased to announce a new partnership with Tradefora, an independent provider of pre and post trade execution analytics. The new Tradefora TradeGuard service offers your customers peace of mind by letting them check their executed prices against the overall market as the trades are placed, thus increasing transparency and trust in your execution quality and enhancing the trading experience.

One-Time Verification | Live Verification |

*For historic orders from 5K, 20K, 50K and 100K | *For all clients’ order as they take place offering complete best execution transparency |

Through our partnership, your customers can easily identify your brokerage using the feature on our official Commission website and navigate directly into the TradeGuard interface to check their trades.

How does it work?

How can I connect?

What’s the cost?

Tradefora’s pricing is simple and straightforward and depends on the number of monthly active customers, as well as the amount of bulk orders submitted for testing. Brokers can start using the service having completed a bulk order test for €1,000 with a monthly fee starting from just €500.

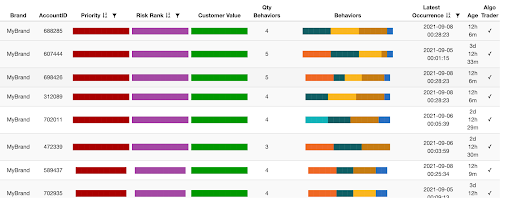

Broker Pilot is a web-based monitoring and risk management platform which aggregates data from many trading servers in real time. This is a virtual Chief Dealer, that automates the work of dealers and instantly responds to various situations on the markets, boosting company’s profit.

Broker Pilot is a certified trading technology provider of the Financial Commission, having demonstrated high commercial standards and satisfied guidelines for security, capacity and other criteria. Financial Commission approved members can now get access to the Broker Pilot virtual dealer suite for 20% off the regular price*.

*The Broker Pilot service is provided at a discount of 20% from the regular price for the first year and is subject to the member being in good standing with the Commission per the Commission’s Rules and Guidelines. After the first year of service, Financial Commission members will be able to take advantage of special pricing offered by Broker Pilot to continue to use the service. The discounted rate will be canceled for brokers who cease membership with the Financial Commission.

Differentiate, retain and grow your client base – maximize profitability

The Financial Commission has partnered with RAZR, a solution from Delkos Research to provide its broker members with a unique solution. Brokers utilizing the RAZR service have been able to streamline high-value sales opportunities, optimize demo to live conversion, and personalize customer journeys that improve marketing spend efficiency while increasing revenue .

Financial Commission broker members can now use this free Customer Retention Calculator to evaluate your Firm’s sales and marketing efficiencies.

The new RAZR Lite, a free version service provides Behavioural Insight, a high-level view of your customer base and daily updates of the top 50 sales and retention opportunities.

This provides our Broker partners a free Proof of Concept opportunity!

The Financial Commission has partnered with GetID – a comprehensive and customizable service that helps businesses verify identities and streamline their customer onboarding processes. Financial Commission broker members can enjoy 50 free verifications* for this unique ID verification and onboarding solution.

GetID’s all-in-one solution includes:

Brokers can quickly and seamlessly integrate GetID into their existing workflow with several options – Mobile and Web SDKs, Cloud-based verification page or API integration. Companies can take advantage of the system’s flexibility by using the administration portal, which allows operations and compliance departments to oversee verification results, easily manage processes and collaborate with team members. GetID’s latest feature called “KYC flow builder” enables developers and compliance professionals to quickly implement online verification into their system in accordance with specific regulatory requirements, set up verification rules, set up multiple verification flows and customize the visual appearance of a user journey. By using GetID broker members can:

Brokers that are already using GetID have been able to increase their customer conversions up to 40% and cut down verification time by 90% according to the latest case study.

*The GetID service is provided with 50 complimentary verifications for broker members who are in good standing with the Commission per the Commission’s Rules and Guidelines.

The Financial Commission has partnered with Finwizard – a new HR consulting service specific to the online brokerage industry to help broker members find the right candidates for their hiring needs. Finwizard and its team have over 15 years of experience in scouting and placing the most qualified candidates in vacant positions for online brokerages around the world.

Financial Commission broker members can enjoy exclusive benefits when using Finwizard as part of their membership* and submit requests for their hiring needs at any time!

Finwizard delivers:

*The Finwizard service is provided with a 50% discount for any fees incurred during the successful first hire for broker members who are in good standing with the Commission per the Commission’s Rules and Guidelines.

The Financial Commission has partnered with Your Bourse – a unique platform-as-a-service fintech provider to help broker members find opportunities to improve profitability using matching engine, liquidity aggregation, risk management tools and more from one platform. The Your Bourse team has over 25 years of industry experience, having developed in-house technologies at various retail and institutional brokerages. At the core of the Your Bourse service is the Liquidity Manager, Matching Engine and MT4/5 Bridge offering brokers a seamless way to route orders and pricing, conduct real-time risk management and client reporting.

The Your Bourse service also offers brokers individual services:

Financial Commission broker members can enjoy a credit of volume fees for up to 3 months* when they sign up for the Your Bourse service!

*The Your Bourse service is provided with a credit of volume fees for 3 calendar months to broker members of the Financial Commission who are in good standing with the Commission per the Commission’s Rules and Guidelines.

The Financial Commission logo is a trademark of Finacom Management Ltd. The Financial Commission © 2013 - 2023